Individual rehabilitation bankruptcy is a private financial delinquent corporate bond under the debtor’s agent system and is an alternative for resolution

[Editorial] Interest on private bonds and delinquency in private finance that are difficult to solve

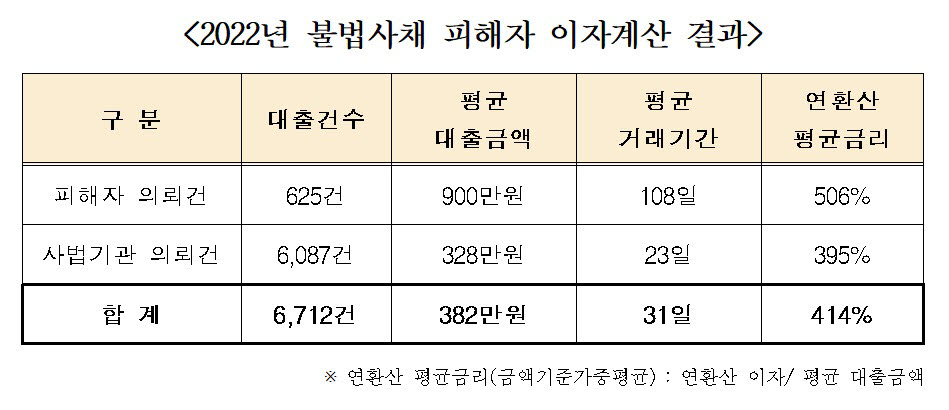

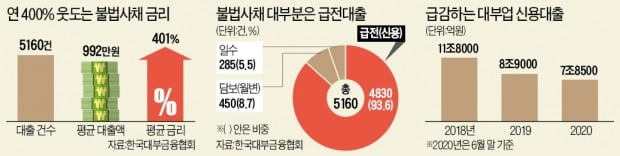

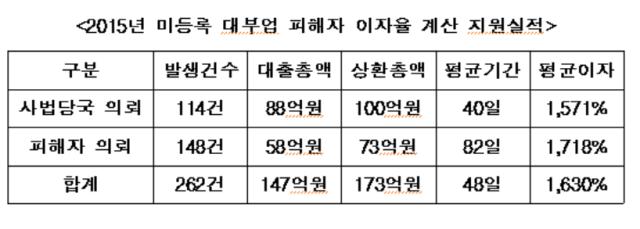

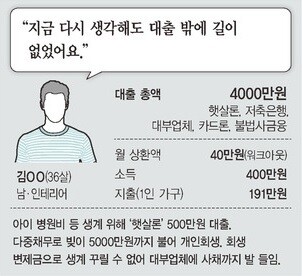

Usually, when it comes to office workers, they often took out loans at low interest rates in the financial sector or used credit cards to solve urgent funds. However, the reality was that it was difficult to use the financial sector if you were not a full-time worker or had irregularities due to lack of a certain income unless your credit score was high. As a result, ordinary people who urgently need money often use lenders or private bonds, but the loan threshold is low, but instead, they have to pay quite high interest rates, which could lead to a vicious cycle in which interest is higher than the principal. suffer from actual private debt interest of personal rehabilitation bankruptcy Because some people live unhappy lives, the government also took measures to help ordinary people.

Of course, even if it is overdue in the financial sector, it is the same as suffering from various demands as well as falling credit scores. However, debt outside the financial sector was worse, and there were cases where they visited workplaces and homes as well as phone calls and e-mails to pressure them close to intimidation. As a result, I suffered from even more severe stress and had a lot of worries, but in response to these demands and collections, there was a debtor’s agent system, which was a way to get help against illegal collection. However, it could be seen that there was a limit to common and normal behavior because only legal solutions were possible.

If you look closely at the debtor agent system, you can get help to reduce the damage caused by overdue private finance if illegal collection takes place.

However, it was sometimes regrettable that it was difficult to respond to demands from other financial institutions. In addition, it was not an essential solution because it could only prevent collection and the actual principal and interest burden remained the same. Therefore, personal rehabilitation bankruptcy requires a letter to be considered in the event of interest on private bonds or overdue private finance, which is difficult to use the debtor’s agent system, and it has become important to consider how to deal with it more specifically.

possible solution along with the debtor’s agent system

In addition to preventing collection, support measures to receive principal and interest reduction of the debt itself were personal rehabilitation that could be applied to the court. This can be said to be a much greater support measure that can suspend the collection itself just by preparing and receiving the start decision after submitting the documents, and if approved here, the principal itself as well as interest can be reduced. In particular, it is a system that helps debtors with excessive debts, especially in that it can solve not only existing loans and credit card payments but also personal loans, especially private loan arrears and interest on private bonds.

However, the system of personal rehabilitation bankruptcy

Only the application of the application, and the application of the application, and the final discharge of the final discharge.First, the type of debt that can apply to the application of financial zones and personal loans and personal loans.However, the amount of money is not possible to pay less than 10,000 won than the debt, and security claims were available to 15 billion won.I couldn’t have a special proposal for the cause of living expenses, so I could apply to life expenses, or excessive shares, or excessive shares, or excessive stock investment or excessive stock investment.

Other requirements are to be able to prove more than a certain amount of future income, but even if you are not a full-time worker, you can proceed with it if you have data to prove your income through comprehensive income tax. However, it was desirable to review the minimum cost of living announced by the government in advance and confirm the qualification requirements because the income should be more than the minimum cost of living for yourself or your family. On top of that, it was also necessary to consider that it would be difficult to apply if you were already exempted within five years.The reasonable response to the delinquency of private finance isIn fact, the interest burden on private bonds is high enough to reach tens of percent, and the priority is to repay them as soon as possible because they can’t handle them, but the level of collection is severe, but legal measures such as seizure proceed quickly. Individual rehabilitation bankruptcy should be prepared in advance to avoid this situation if possible, but if the problem is already serious, it is necessary to review the solution together with the cooperation of an experienced legal representative.Q: What are the benefits of personal rehabilitation bankruptcy?1. The advantages of personal regeneration was given to the application, so I was preferred to prepare for the qualification conditions.2. If the basic condition is met, the application, the application, the action of all collection, the action of all collection, and it could not be prevented from taking the action.If you demand, it is possible to use the obligor system to handle illegal use the obligor system to reduce crisis.3. After the full-scale rehabilitation plan review and the amount of money, the amount of money, the amount of money, and the payment was completely discharged.4. I think that I experienced people who experienced a financial delinquent system, but I would like to solve the problem with the legal agent.Previous image Next imagePrevious image Next imagePrevious image Next image

![[회고] 아임웹을 이용해 홈페이지를 디자인하다 [회고] 아임웹을 이용해 홈페이지를 디자인하다](https://m.imaeil.com/photos/2024/01/10/2024011016240131901_l.png)